Although Hawaii imposes a gross receipts tax called general excise tax (“GET”), businesses are generally allowed to pass the tax on to buyers similar to sales tax and can even impose a higher rate on these transactions to capture the margin, effectively making the tax a no cost to the business. New Mexico is similar; the state imposes a gross receipts tax that businesses can pass on to consumers.

In addition to the above, some cities also impose their own gross receipts tax:

- Los Angeles (LA Business Tax or LABT)

- San Francisco

- Philidelphia (Business Income and Receipts Tax or BRIT)

- Portland

- Over 40 individual localities in Washington impose B&O

Other Taxes Business Should be Aware of

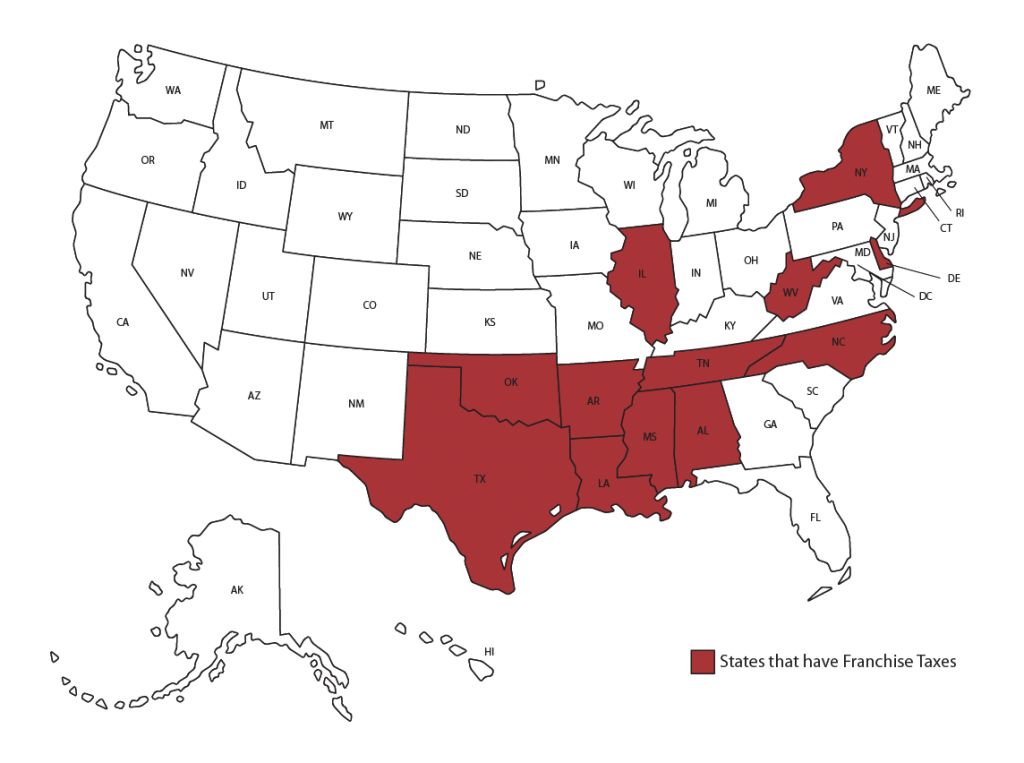

Several states have franchise taxes that can be similar to corporate income tax or GRT but is a separate level of tax altogether. Texas, for example, has a franchise tax, but there is debate on whether it is an income tax or a gross receipts tax based on how it is calculated, which is based on what they define as the “margin.” Each state that imposes a franchise tax has different rules on what business entities are required to file them and on what exactly the calculation is based on. Additionally, some states may only have a franchise tax that functions as a corporate income tax while others impose both a franchise and a corporate income tax.

States that have franchise taxes are:

Other types of taxes exist such as annual/biannual business reporting requirements and business license taxes that can exist not only on a state level but a city and county level as well. There are also industry-specific taxes such as alcohol, tobacco, motor vehicle and petroleum taxes to be aware of if you operate in such industries. Many states have different types of reportings and taxes and it is important to understand what your business requirements are. We have found some businesses to have only a fundamental understanding of these taxes since they are indirect and can lead to a lot of confusion as to what tax obligations a business may have. We work together with your CPA, tax director or CFO to help determine your business compliance needs. For more information please contact us at info@pmbusinessadvisors.com

Related Resources

-

GuidesLearn More

-

GuidesLearn More

-

GuidesLearn More