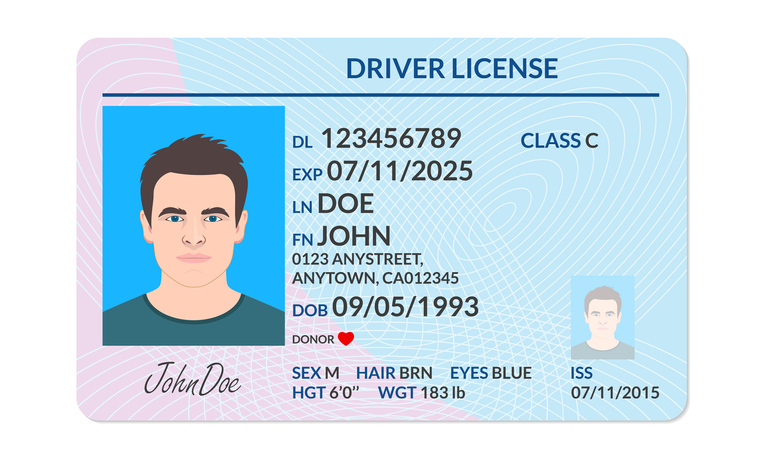

Majority of sales tax registrations are administered at the state level, however, there are some exceptions to this rule. For more on these exceptions please see the excerpt below for “Home Rule Self- Administered Localities”. Generally, each state prepares a questionnaire to determine what type of business you have, what products are sold, and the Start date. These applications also require personal information from responsible persons and/or corporate officers. Some of these include but are not limited to.

- Full Name

- DOB

- SSN

- Home Address

- Home Phone

- Copy of Driver’s License

Most applications on average take 10-30 mins to complete and can be done by visiting the respective state’s online sales tax platform. For most states, this process takes 7-10 business days before the official sales tax license is received in the mail.

Home Rule Self-Administered Localities

States such as the ones listed below have independent self-governing localities in which the taxation filings and registrations are not only held on the state-level but also are held on a county and city level.

- Colorado

- Alabama

- Louisiana

- Alaska

- Arizona

- Idaho

When applying for sales tax in these states please be sure to file directly with the state for sales tax, but also with your local sales tax office. For best practices, new businesses should contact a sales tax specialist or appear in person at the respective city and county tax department offices.

Obtaining a Business License

The business licensing process, while similar to the sales tax process, requires in most cases much more participation from the business management. In general, business licensing are multi-level (state, federal, city, and countywide) and often requires multiple forms and documentation in order to complete. Some key documentation and figures needed for business licensing include but are not limited to;

- Owner Driver’s License/Passport

- List of officers, members, or owners

- Floor plan of retail/wholesale space

- Landlord information

- Expected Annual sales Amount

- Average Inventory on Hand

- Business start date

- Notary

Determining all the necessary licenses your business needs is a very daunting task, for best practices consider hiring a consultant or visiting the local business licensing agency in person. For most businesses, excluding businesses that sell “special products or services” such as alcohol, firearms, tobacco, and live entertainment, the list below can be used as a general guideline for the most common licenses need to remain in compliance.

- General Business License

- Fictitious Name

- Occupancy Permit

- Building and Planning Permit

- Hazardous Waste/ Waste Disposal

- Weights & Measures

- Fire Alarm Permit