An Accounts Payable audit will effectively deliver results that provide insight into improving your internal processes.

There comes a time in every business when you are faced with the challenge of reducing costs. You have tried to reduce budgets but are not hitting those goal numbers. Why not consider an Accounts Payable Recovery Audit!

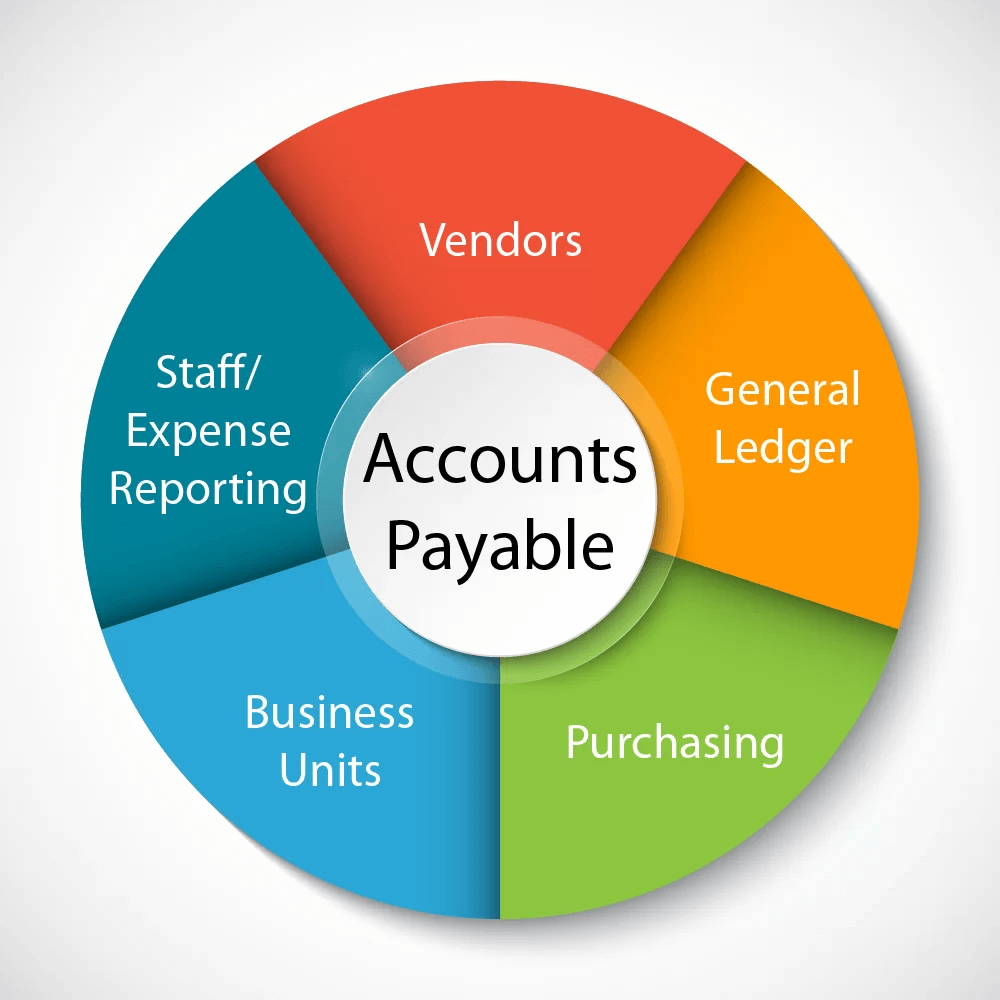

The fundamental yet most valuable part of an audit is not only to recover money due back to you but to also understand the findings via high-level summaries to help you SAVE money. Being proactive will not only help you save money but will also help you avoid future losses on overpayments, duplicates, and gaps in your process. The goal is to provide you with audit findings through user-friendly visuals and metrics and by doing so, your management teams can easily pinpoint areas of the business that may need additional attention. The audit summaries and the issues they may uncover, give you the option to do a deep dive straight to the root cause of a particular issue within your AP process.

Let’s Keep Our Eyes Wide Open

You may think that you have the right people and proper processes in place to avoid such overpayments and unused credits, but no process is perfect. There is always a risk involved concerning human error. Also, businesses with recent organizational changes might prompt the need for an Accounts Payable recovery audit. Here are a few:

- Recent organizational and/or staff changes presenting training issues

- Multiple suppliers and disbursement locations such as duplicate vendors resulting in duplicate payments

- Implementing new technology or system upgrades where system limitations or gaps may be present

- Recent mergers, acquisitions, and expansions where systems are not integrated and erroneous/duplicate payments are made across multiple corporate entities.

Each company has its own set of challenges and unique circumstances while functioning in a fluid and ever-changing business world. Now is the time to keep your eyes wide open so your bottom line isn’t negatively impacted by the complexities of your business!