Computation of credit for 2011–2022: For tax years 2011 through 2022, the credit is based on the excess, if any, of the qualified research expenses for the taxable year over the base amount as defined in IRC § 41(c), and is computed as follows:

- if the total is $2.5 million or less, the credit will be 24% of that amount

- if the total is over $2.5 million, the credit will be $600,000 plus 15% of any amount exceeding $2.5 million

- Any amount of additional credit that exceeds taxes due is not refundable, but may be carried forward for five consecutive tax years*

For 2023 and thereafter, the R&D tax credit percentages will be 20% of the first $2.5 million in qualifying expenses plus 11% of the qualifying expenses in excess of $2.5 million.

How to obtain the credit?

A taxpayer seeking a refund must submit an application to the Arizona Commerce Authority (ACA) prior to filling out its tax returns. The refund must be claimed by the applicant or its partners on an original Arizona income tax return along with Revenue Form 308 (for corporations) or Arizona form 308-I (for individuals).

Refundable/Transferable Tax Credit- Yes*

Carryforward

Unused credit may be carried forward for 15 years. Taxpayers with qualified research expenses to carry forward from tax years starting before January 1, 2001, may only carry forward 20% of the carry forward expenses.

Flow-Through Entity

If two or more taxpayers, including partners in a partnership and shareholders of an S corporation, as defined in section 1361 of the internal revenue code, share in the eligible expenses, each taxpayer is eligible to receive a proportionate share of the credit.

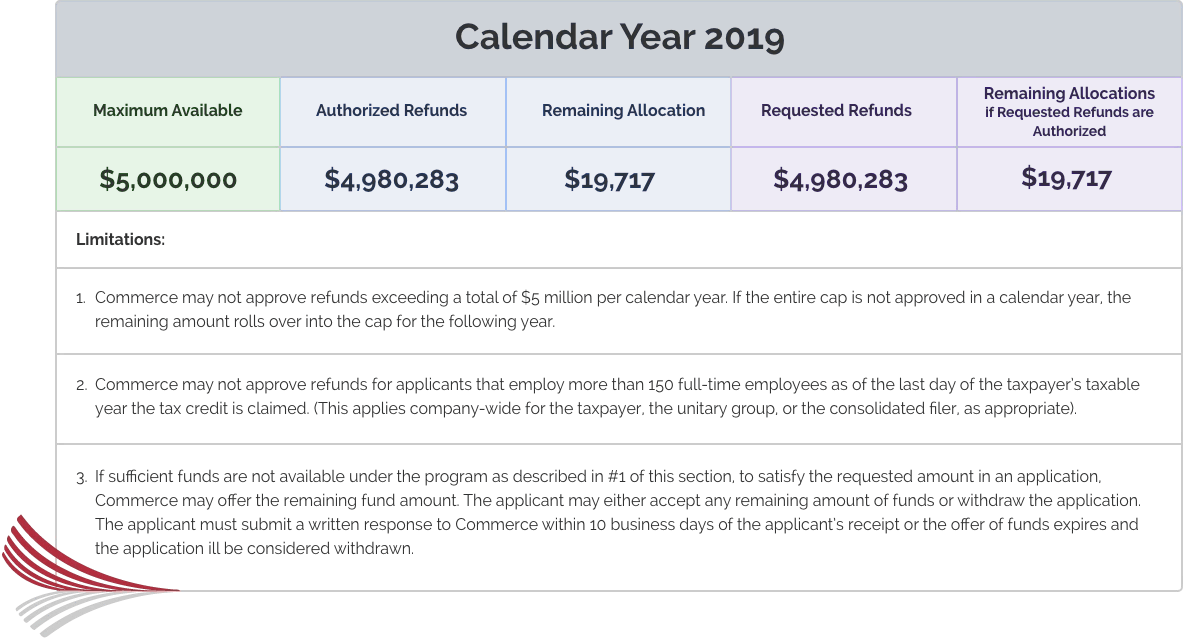

Research & Development Tax Credit Refund Allocation Table

Updated March 20, 2019 – Source: AZCommerce.com

Refundable/Transferable Tax Credit- Yes*