- Research that has a specific commercial objective may qualify as “basic research.”

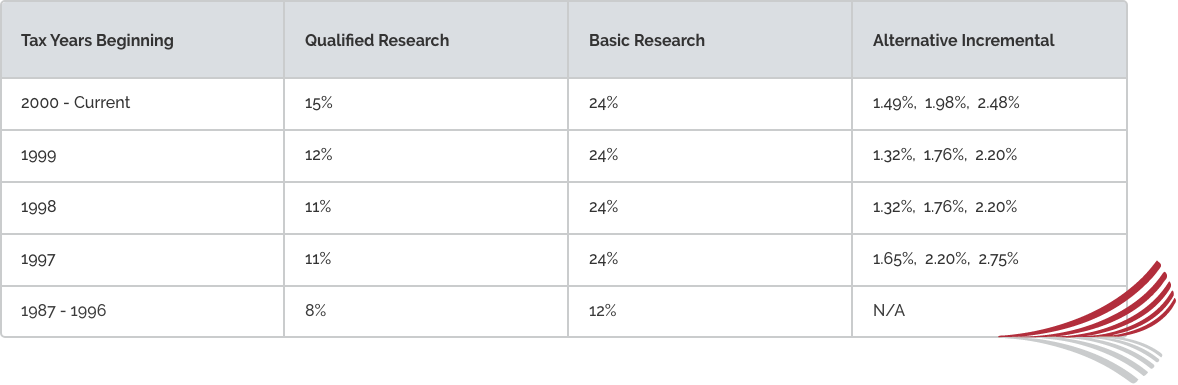

- For taxable years beginning on or after January 1, 2000, the credit is equal to 15% of the excess of the qualified research expenses, over the base amount, plus 24% of the basic research payments.

- The credit can be carried over indefinitely, but it cannot be carried back.

- California gross receipts include receipts from the sale of real, tangible, or intangible property held for sale to customers in the ordinary course of the taxpayer’s trade or business that is delivered or shipped to a purchaser within this state. This would include sales to the U.S. government, which could be identified as delivered in California. Excluded receipts would be items such as “throwback” sales, as well as receipts from services, rents, operating leases, and interest.

- The credit has no termination date for California purposes.

Refundable/Transferrable Tax Credit – No

- The California research credit is 15% of the excess of current year research expenditures over a computed base amount.

- 24% of basic research expenses for university-based research for the taxable year determined in accordance with IRC § 41

Carryforward

If the credit exceeds the tax for the taxable year, the excess may be carried over to reduce the tax in the following year, and succeeding years, if necessary, until the credit has been exhausted.

Flow-Through Entity

S-Corporations may claim 1/3 of the research credit against the 1.5% entity-level tax after applying the limitations relating to passive activity losses and credits. However, S-Corporations are not eligible for the “basic research” credit. (IRC §41(e)(7)(E)(i)) S-Corporations can pass through 100% of this credit to their shareholders on a pro-rata basis. The amount of research credit passed through to the shareholder on the Schedule K-1 may be limited to the amount of tax attributable to the shareholder’s interest in the S-Corporation (IRC §41(g)). To determine the shareholder’s credit limitation, see FTB Form 3523 – Line 40 instructions.